Abiotic ressources

Introduction

Définition : « Abiotic ressources » [1]

Firstly, biotic resources refers to ressources coming from living things, or more precisely, organic matter. Ex: animals, plants.

Consequently, abiotic resources refers to all ressources but biotic ones. So, it encompasses minerals, but also air, water, sunlight, etc.

Fossil fuels can be classified either as biotic or abiotic resources, depending on the timescale considered. Indeed they’re coming from living things, resulting of bio-geo- chemical cycles, but were definitvely formed milllion years ago. In EV14, we’ll consider them as abiotic.

But what even are « resources »? [1]

Surprisingly, it is not often explicitly defined, even in major texts. Ex: ISO 14040 norm (giving framework for all Life-cycle analysis), or the classical 1983 report of the United Nations.

Analysis of varied definitions highlights some converging points: a resource is considered as such if :

It has an value or utility (from material properties for an industrial process to cultural valorization of precious stones)

For a certain subject (generally considered: the humans)

[1] BEYLOT, A. et al, 2020. DOI 10.1016/j.resconrec.2020.104748

General caracterizations

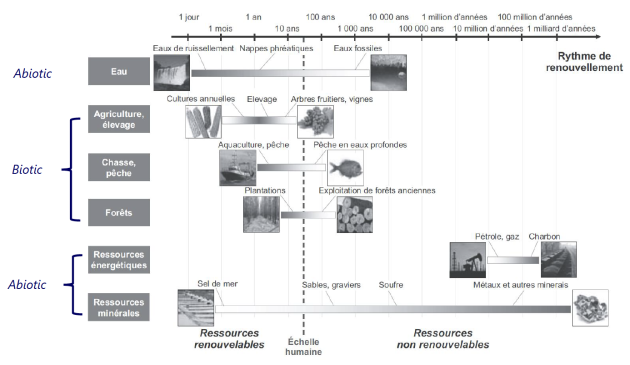

The renewable/non-renewable polarity [2]

Renewable when the stock reconstitutes itself at a « sufficiently quick rate ». Usual threshold: timespan of a human life.

Non-renewable when they constitute themselves on a long period of time, way longer than a human life. Their use is always a depletion in available stocks.

[2] Resource, 2020. Wikipedia[online].

[3] BIHOUIX, P., GUILLEBON, B., 2010. Quel futur pour les métaux.

The availability/non-availabilitypolarity

Available when concentration and position let them be technically AND economically usable by humans.

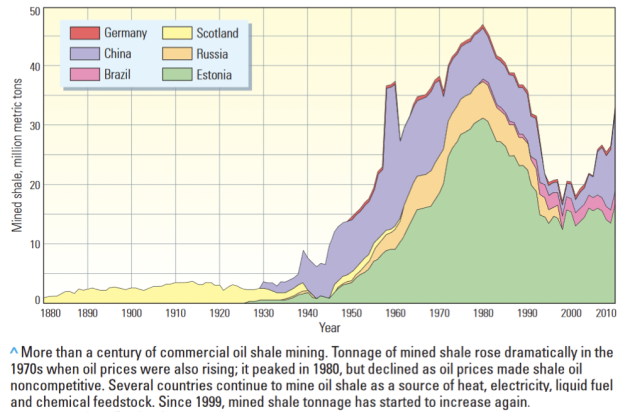

More or less available according to the variation of these dimensions. Ex: Oil shale in the XXth, depending on stocks’ concentrations and competition with conventional crude oil. [4]and [5]

[4] History of the oil shale industry, 2020. Wikipedia [online].

[5] Allix et al., 2010. Coaxing Oil from Shale. Oilfield Review [online]. 2011.

[6] BP, 2020. BP Statistical Review of World Energy. [online]. 2020

Médias

Consomption of abiotic resources

Main threads of the course : Metals and Oil

Metals

Brief global history

Contemporary trends

Oil :

Brief global history

Contemporary trends

Sociotechnical perspective (Tutorial work)

Main threads of the course

The mineral resource example: Metals

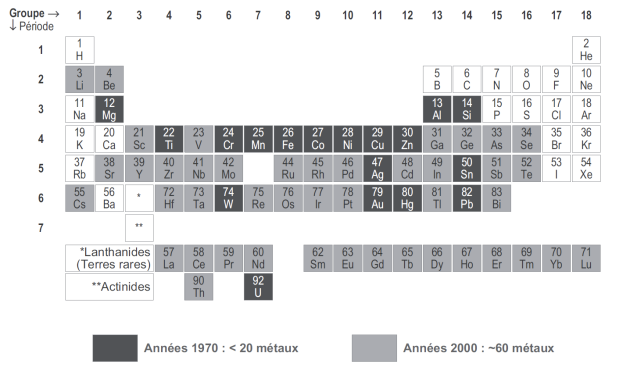

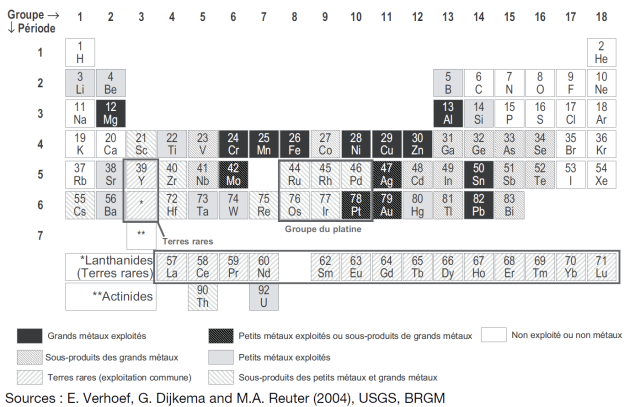

Why metals? On the 118 known atoms, most of them are metals :[3]

85 metals

6 metalloids

17 non metals

10 non determined

General properties :

electrical & thermal conductors

mechanical ductility

Geological forms: oxides (common) > sulfides (less common) > natives (uncommon)

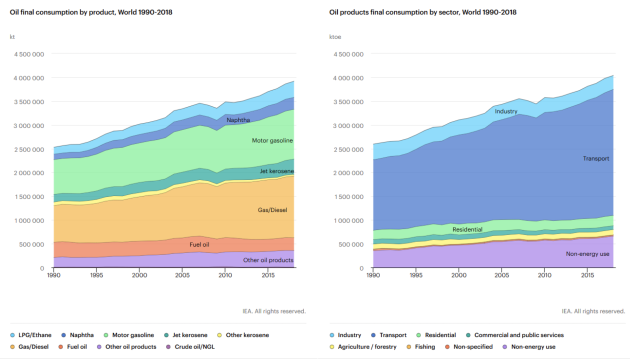

The energetical resource example: Oil

Currently, most used source in main primary energy consomption :

Oil (33,1%)

Coal (27%)

Natural gas (24,2%) [6]

Regroup varied forms of derived fuels (petrol, shale oil) and secondary resources

General properties: gives a lot of secondary resources when refined, good energy density, easy and convenient to transport and to use as energy vector in varied contexts

Metals

Metals global history

A very brief summary [3]

Contrary to first intuition: native metals were the first to be used. Although uncommon (often mixed) they were ealily recognizable:

Copper (at least 8000 BC, and melted since 4000 BC), Gold and Silver (4000 BC)

Alloys starting in 2500 BC with Bronze (Tin & Copper)

Furnaces since at least 1000 BC let reduce oxides (notably, Iron oxide) and developp experiments on alloys (Steel = Iron + Carbon)

Lead, Antimony, Mercury used pure or in allows during Antiquity

This tiny number of metals has constituted the main uses until the XIXth century and structured economical and geopolitical relationships between populations

Besides native platinum in Peru, other metals like Nickel, Zinc, Cobalt have been identified by chemistry and metallurgy (beginning of XVIIIth). And then: Manganese, Molybdenum, Tungsten, Titanium (end of the XVIIIth).

Electrolysis in XIXth allows to separate most elements in pure form, but weak rate of use until the XXth century.

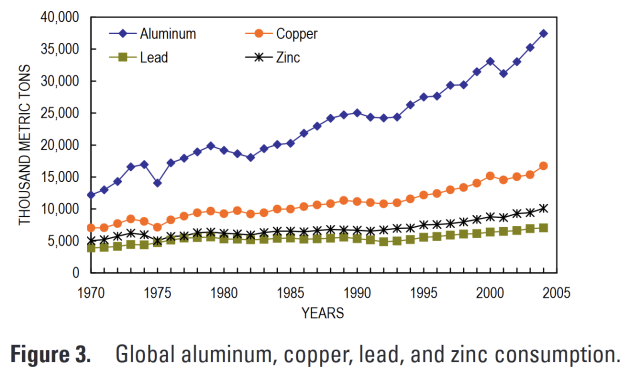

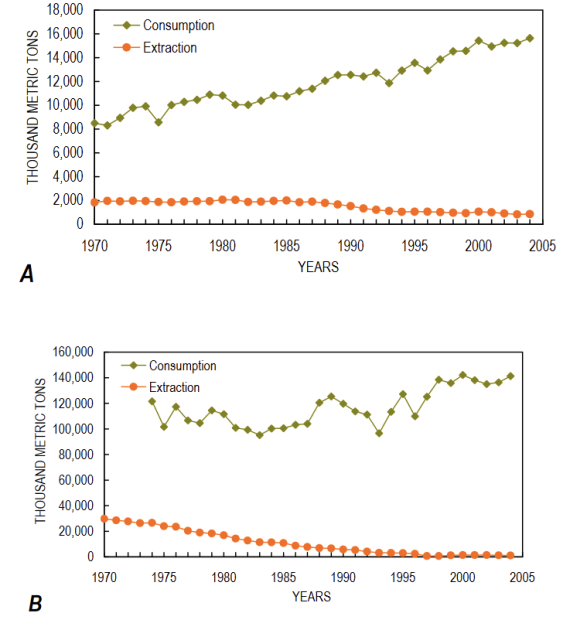

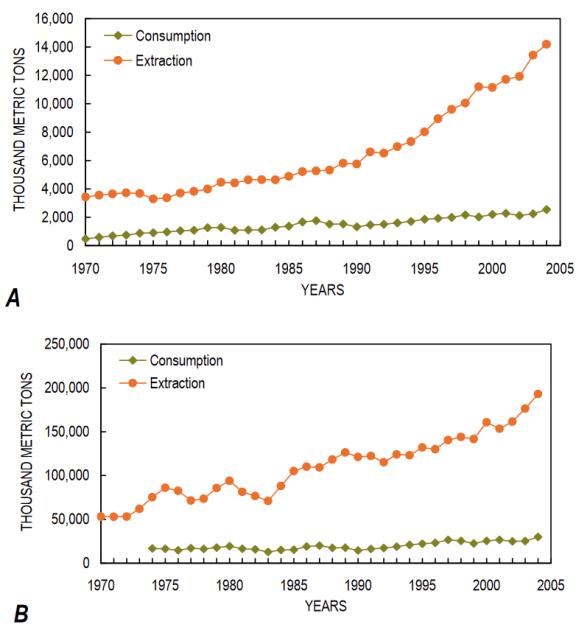

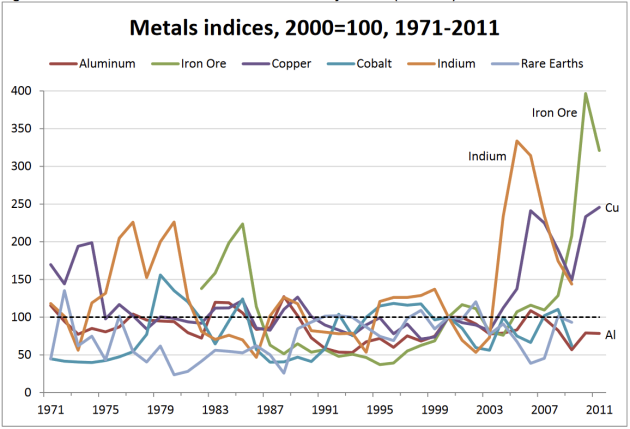

Contemporary trends

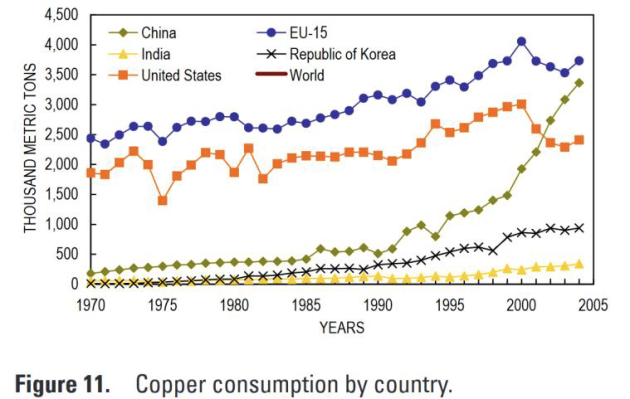

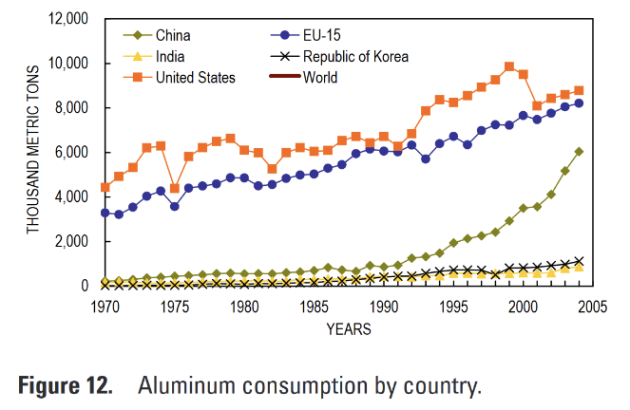

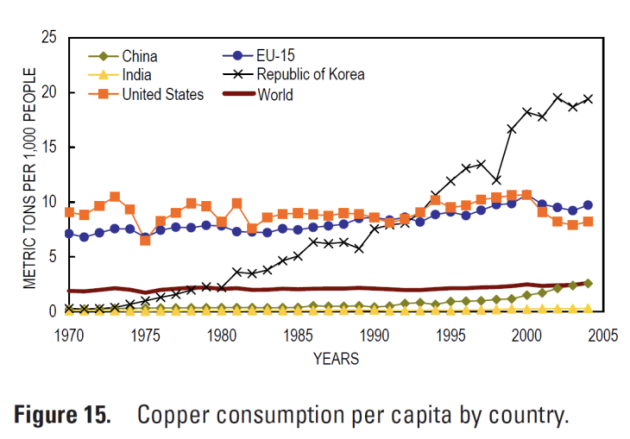

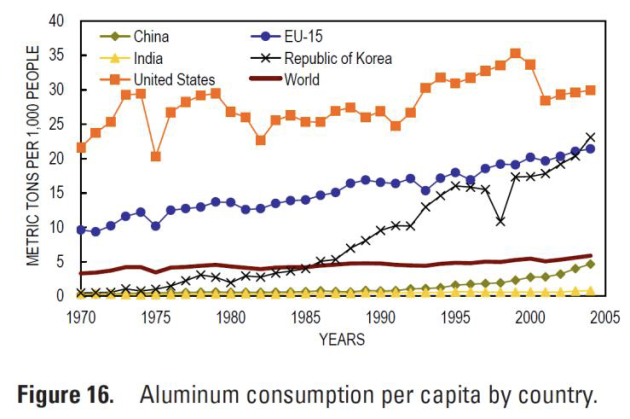

Continuous growth in use of base metals

Countries high disparities

Global Extraction/Consomption pattern

Growing variety of metals for expanding specific uses

Medias

Oil

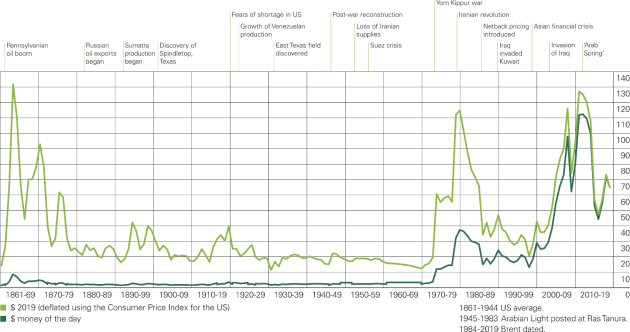

Oil global history

A very brief summary [8]

Oil has been used for a long time in varied forms

Used as fuel as back as 400 BC in China

Used for lighting or in the asphalt form for construction as back as 2000 BC in Babylon

Crude oil already distilled by Persian chemist in 9th century to obtain tar, used for streets’ paving

Distillation arrive in Europe in 12th century through Islamic Spain

The mid19th –early20th turning point [9]

First industrial oil well and oil refinery around 1850

Consomption stayed low (5% of world energy in 1910), as oil as not that interesting at first, compared to wind or animals for transport, solar& coal were largely dominant for thermal power, etc.

Complex and crossing technical but mostly political phenomena let oil grew in varied uses, to represent more than60% of world energy as soon as 1970

[8] Petroleum, 2020. Wikipedia[online].

[9] BONNEUIL, C., FRESSOZ, J-B, 2016. The Shock of the Anthropocene. The Earth, History and Us.

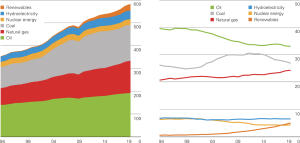

Contemporary trends

No primary energy transition

Three main profiles

Consistency of uses

Medias

Extraction of abiotic resources

Reserves

Definitions

Metals focus

Concentrations

Mineralogical wall

Oil focus

Assessing reserves

Caution in interpretation

Impacts of extractive activities

Growing interdependancies

Energy footprint of minerals

Material footprint of energy

Environmental focus

Other abiotic resources: water & air quality

Biotic resources: wildlife and land

Socio-economical focus

Contrasted local realities

Global frictions…

Rootedin historical inequalities

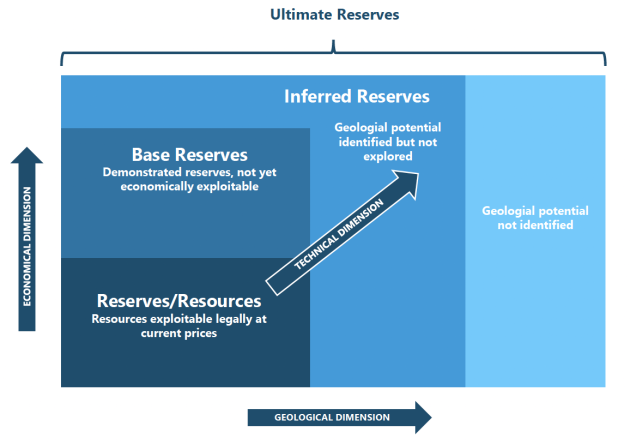

Reserves

Adaptated from [3]

[3] BIHOUIX, P., GUILLEBON, B. ,2010. Quel futur pour les métaux?

[11] USGS, 2014. Estimate of Undiscovered Copper Resources of the World[online]. Fact Sheet.

[12] USGS, 2020. Mineral Commodity Summaries[online].

Reserves/Resources data are highly dynamic

May be reduced as

ore is mined

feasibility of extraction diminishes

May increase as

additionnal deposits are discovered

currently exploited deposits are thoroughly explored

The Copper example : [11] & [12]

Reserves/Resources≃500 Mt (2014) -> 870 Mt (2020)

InferredReserves≃2.1 Bt(2014)

UltimateReserves≃3.5 Bt(2014)

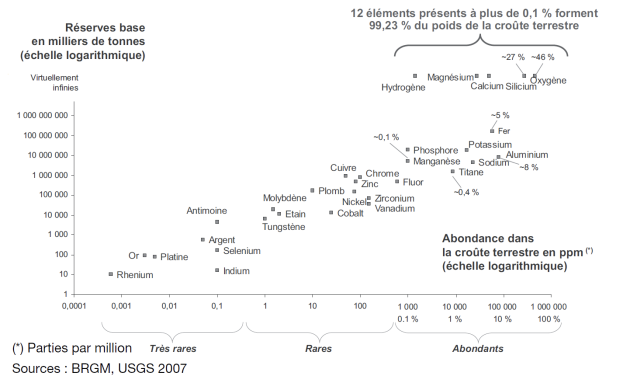

Metals focus

[3] BIHOUIX, P., GUILLEBON, B. ,2010. Quel futur pour les métaux?

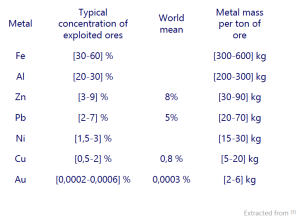

Concentration of minerals

Extracted from [3]

Average concentrations of minerals in Earth crust must be compared to typical concentrations in exploited ores

Even for abondant elements, high ratio between economically viable concentrations and Earth crust average

Iron(Fe) example: 30-60 % in ores versus 5 % average in Earth crust

Precious metals are logically the only ones where the order of magnitude is equivalent

Typical example: Gold (Au)

[24] PRIOR, T et al., 2012. Resource depletion, peak minerals and the implications for sustainable resource management.

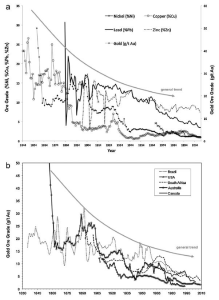

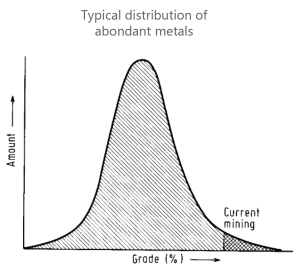

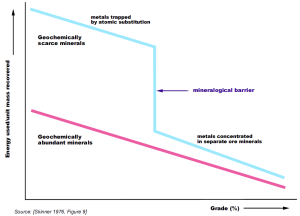

B. Mineralogical barrier

Abondant metals mining follows a simple curve :

Highest-grade ores are mined first, as they’re the most available ones–technically and economically

Like for any finite resources, mining depletes stocks, then target less high-grade ores, until a production peak happen, after what availability diminishes

Extracted from [13]

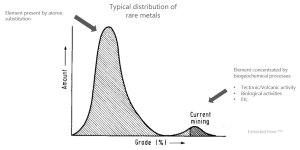

Scarce metals are usually not found in common rocks as separate minerals but as atoms substitutions (that’s makes them rare)

Consequently, mining activities directly seek concentrated ores (geologically rarer themselves), then must rely on more common ores, following a bimodal mining curve

Extracted from [13]

[13] SKINNER, B.J., 1979. Chapter 10 A Second Iron Age Ahead? In: Studies in Environmental Science. [14] AYRES, Robert U, 2001. Resources, Scarcity, Growth and the Environment. . 2001. P.35.

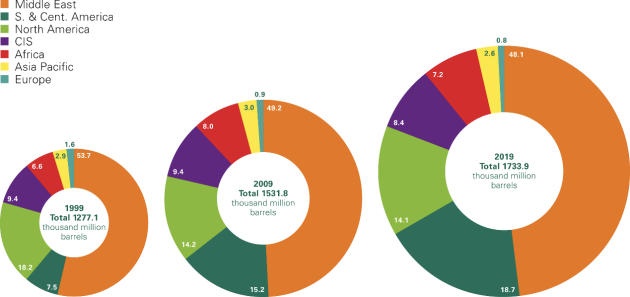

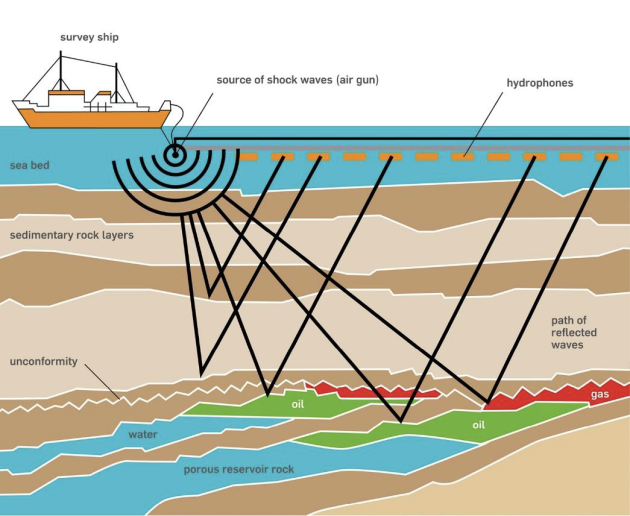

Oil focus

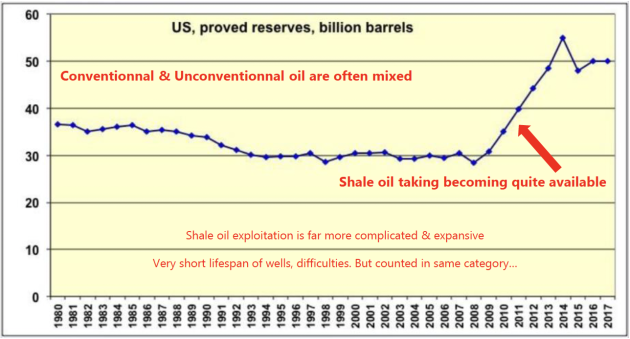

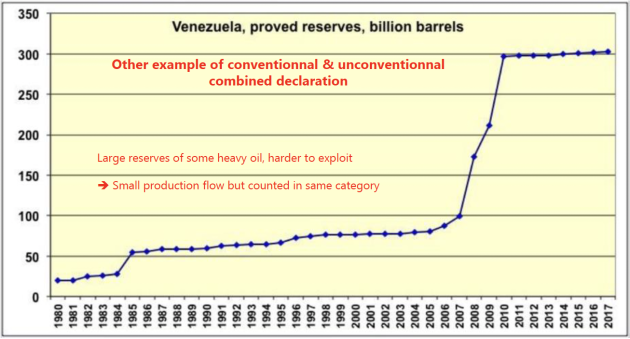

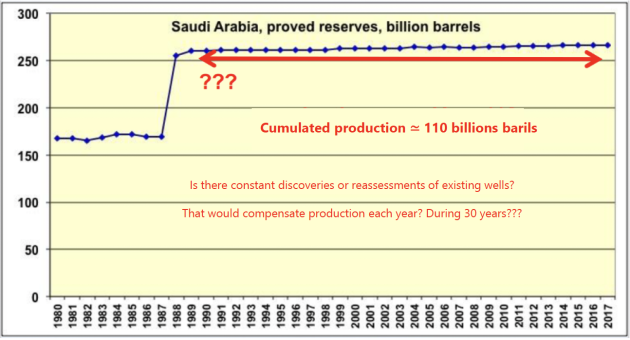

Assessing reserves [15]

Extracted from [6]

[6] BP, 2020. BP Statistical Review of World Energy. [online].

[15] JANCOVICI, Jean-Marc, 2019. Les Energies fossiles. Ecole des Mines [online].

When a potential reserve of oil is suspected, sismography combined with exploratory drilling is used to estimate :

Quantities of oil

Probable recovery rate of the oil

As any oil extraction needs heavy infrastructure -> CAPEX>>OPEX.

Which means the dynamics of a specific reserve are :

Strongly dependent on quantities& recovery rates estimations accuracy

Weakly dependent of variations in oil price(infrastructure already there)

Who evaluate & declare the reserves?

A lot of oil companies are state-owned. Around 10% of oil compagnies are listed on the stock exchange -> legally binded to communicate the estimations

Large part of data comes from countries but :

Geopolitical strategies due to production international agreements

Different conventions on what to count and in which category

No independent verifications

Caution in interpretation

Medias

Impacts of extractive activities

Growing interdependancies

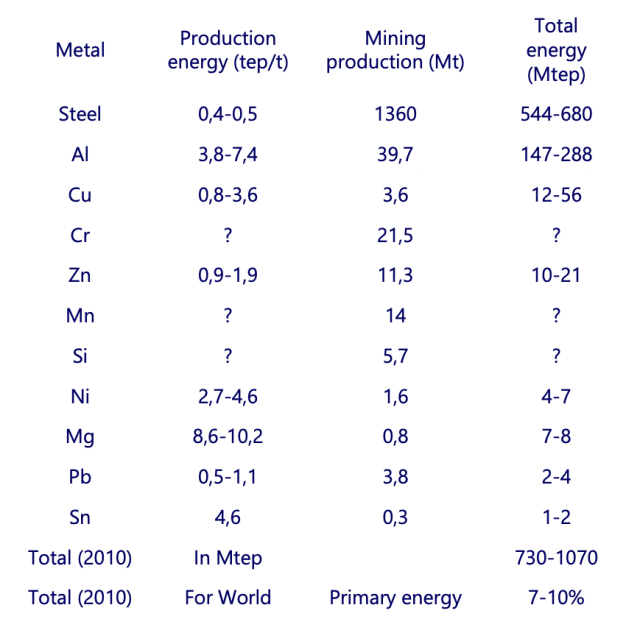

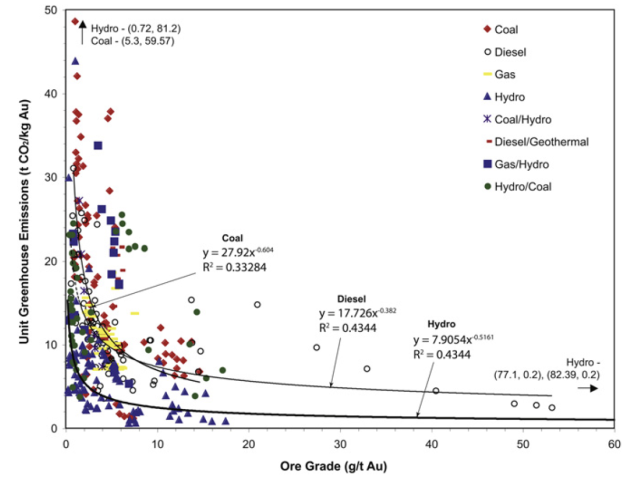

Energy footprint of minerals

A lot of operations involved

Extraction, mineral processing, metal working

1st order transformation: smelting and refining

Transport between steps

This raw metal undergo varied 2nd order transformations to become raw products with diverging final energetical footprint

Copper example: tubes 20-30% higher footprint than foils

Uncertainties in data

Diversity of production sites (mineral concentration, efficiency of processes)

Varied studies perimeter (no standard approach, weigh of hypothesis)

Disparities in sources of information available

Extracted from [3]

Extraction & Refining of metals

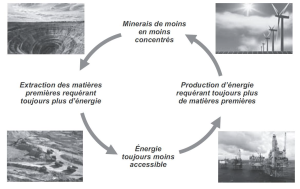

Less & less concentrated mineral resources -> more & more energy

Extracted from [24]

[24] PRIOR, T et al., 2012. Resource depletion, peak minerals and the implications for sustainable resource management.

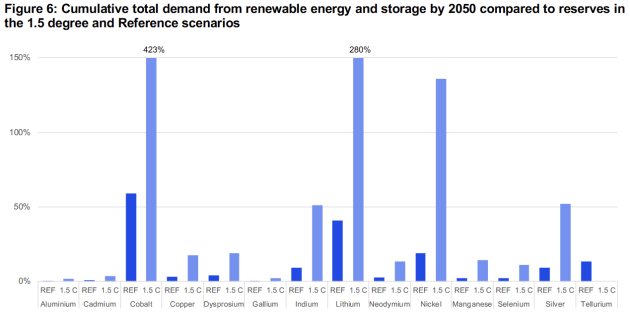

Material footprint of energy

Extraction & Refining of oil

≃5% of world Steel use for gas/oil exploration & production

‘Offshore’, ‘Depp offshore’, or

Unconventionnal oil -> rise in the use of platforms, ships, complex tools, etc.

Even « Renewable energies » are quite materially dependent:

A 1MW windmill contains ≃ 3t of Cu, and needs 10x more steel & concrete per kWh than a classical plant

A classical PV installation (Si) needs ≃ 4kg of Cu per kW capacity.

Most these technologies also need rare metals like In, Ga, Se, Ne, etc.

Environmental focus

Other abiotic resources: water & air quality

Impacts on abiotic resources: water & air quality [16] & [17]

[16] ELAW, 2010. 1st Edition: Guide pour l’évaluationde EIE de projetsminiers [online].

[17] Hydraulic Fracturing 101. Earthworks [online].

[3] BIHOUIX, P., GUILLEBON, B. ,2010. Quel futur pour les métaux?

Mines dewatering

Mining sometimes directly meet the groundwater table -> pursuit of mining need pumping of water -> reduction or elimination of water circulation in surrounding zones, varied degradations on soils and wildlife

Ex: Sadiola Gold mine pumped 5,6 Mm3 of water in a year (≃ consommation of 800 000 Malians) [3]

Mobile or non-mobile sources of air pollutants

Fuel combustion & exhaust gases of machines or vehicules -> CO2, CO, organic compounds -> climate change

Waste particles dispersed by wind

Precious metals are often melted onsite before sent to rafineries -> high levels of Hg, As, SO2

Uncontrolled mercury (Hg) rejections

[Hg] in ores can rach 10 mg/kg -> 1 Mt of ores produced means 10t of Hg potentially emitted

Vaporization of Hg in gold metling is a major cause of Hg mission in atmosphere

Specifics to oil :

Hydraulic fracturing & Oil spills contaminations

Details in [17]

Biotic resources: wildlife and land

[16]ELAW, 2010. 1st Edition: Guide pour l’évaluationde EIE de projetsminiers [online].

[17] Hydraulic Fracturing 101. Earthworks [online].

Loss of habitat

Excavation or accumulation of waste -> mobile species (birds and some mammals)are hunted out + sedentary species (little mammals, reptiles, invertebrates) are killed

Acid drainage or dewatering -> severes impacts on surrounding aquatic life

These 2 points -> perturbation of trophic chains (diminution of food for the higher- level predators)

Disparition of vegetation

Fracture of habitat

Large portions of land occupied

-> perturbation of migrations or local isolation of species

Specifics to oil (again):

Hydraulic fracturing & Oil spills contaminations

Details in [17]

Socio-economical focus

[16] ELAW, 2010. 1st Edition: Guide pour l’évaluationde EIE de projetsminiers [online].

[17] Hydraulic Fracturing 101. Earthworks [online].

[3] BIHOUIX, P., GUILLEBON, B. ,2010. Quel futur pour les métaux?

Contrasted local realities

[16] ELAW, 2010. 1st Edition: Guide pour l’évaluation de EIE de projets miniers [online].

[17] Hydraulic Fracturing 101. Earthworks [online].

[3] BIHOUIX, P., GUILLEBON, B. ,2010. Quel futur pour les métaux?

Human migrations

Displacement & reinstallation of communities (expropriated or not) -> resentment + power perturbations -> local conflicts

New high economic activity -> arrival of new populations -> new pressures on land, water or waste management -> tensions & potential conflicts with original inhabitants

Ex of Grasberg Mines in Indonesia: From <1000 (1973) to 110 000 (1999) ; violent conflicts during 1970-1990

New needs of infrastructures -> urbanization -> wide-ranging effects

Loss of drinkable water access

Due to uncontrolled exploitations & industrial pollutions

Pressures on means of existence

Mining activities not correctly managed -> economic cost on other sectors (agriculture & fishing in particular)

Public health consequences

Potential sanitary risks are often seglected

-> example of improvised mining towns are been shown to threaten food security and availability

Indirect effects of exposition to mining activities are higher incidences of tuberculosis, asthma, chronic bronchitis, etc.

A review of metals direct toxicity impacts can be found in a dedicated chapter of [3]

Cultural & Esthetics

Destruction of cultural resource by surface perturbation or excavation

To pographical or hydrological changes

Higher access to previously inacessible locations

-> theft or vandalism of cultural artifacts

Visual impacts due to deforestation& presence of infrastructures

Global frictions...

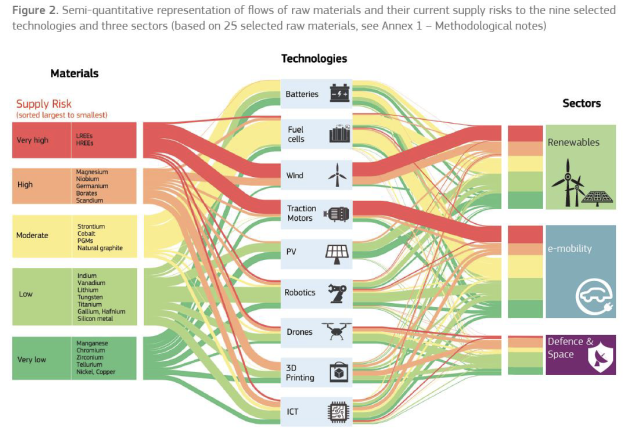

[25] HUISMAN, J., PAVEL, C., et al. 2020. Critical Raw Materials in Technologies and Sectors -Foresight [online].

[3]BIHOUIX, P., GUILLEBON, B. ,2010. Quel futur pour les métaux?

Emerging geopolitical stakes for metals

As for oil, the main consumer countries are also the ones with the smallest reserves

Understanding of these problematics is more recent for metals and is parallel to the recent rise of metals prices in the 2000s

The EU Commission now regurlaly pubish reports on the matter[25]

Strategical stocks of metals constituted during Cold War, dismantled after the 90s, are back since15-20 years

Capitalistic concentration of compagnies :

in 2008, 4173 compagnies in mining but 149 majors (3,6%) were controlling 83% of the market[3]

Power to initiate struggles with states over natural resources and their exploitation, in order to maximize private profits and mutualize losses or environmental externalities

Complex conflicts with explicit and implicit actors

[3] BIHOUIX, P., GUILLEBON, B. ,2010. Quel futur pour les métaux?

Armed conflicts already existing

Not as visible as oil conflicts yet

DRC (Democratic Republic of the Congo) being the richer african country in metals, its history since mid-XXth is a paradigmatic example

Crossings with colonization & neocolonization

1961 Defense agreements between France, Niger, Dahomey & Ivory Coast garantee limitation of exportations to other countries than France in case of needs

2007 contract of China & RDC: heavy construction work (6 billions $) in in exchange of metal mining authorizations (10 Mt of Cu, 200 000 t of Co, 372 t of Au)

With explicit intention of asking land if the metal provisionning does not meet expectations

Direct implication in local economy

No need to developp on the well known history of oil geopolitical conflicts since mid-XXth!

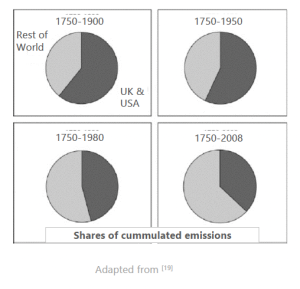

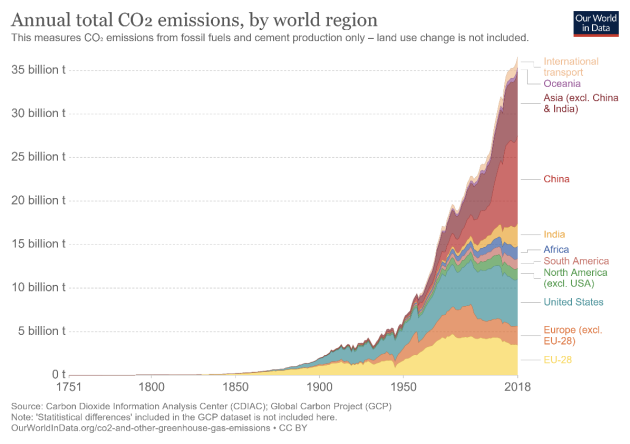

Rooted in historical inequalities

[3] BIHOUIX, P., GUILLEBON, B. ,2010. Quel futur pour les métaux?

[18] RITCHIE, Hannah and ROSER, Max, 2017. CO₂ and Greenhouse Gas Emissions. Our World in Data[online].

[19] BONNEUIL, C., FRESSOZ, J-B., 2016. L’événement anthropocène: la Terre, l’histoire et nous.

20th century have mainly reorganized exploitation, but it continued on

USA based its economic rise on intensive use of its own resources during 1870-1940

Supported decolonization mainly to gain access to material resources of newly independant countries

Conversely, East block exploited its own environnment above all

Emerging trend ->

Reappropriations of national resources & path of developpmen

Setting of export restrictions [3]

Medias

Perspectives of abiotic resources

A matter of Stocks

The stocks’s stakes

Climate change – CO2 eq « stock »

[6] BP, 2020. BP Statistical Review of World Energy. [online].

[20] EIA, U.S. Energy Information Administration, 2016. Carbon Dioxide Emissions Coefficients. [online].

[21] IPCC. 2018. Mitigation Pathways Compatible with 1.5°C in the Context of Sustainable Development. . P. 82.

Oil emissions of current reserves

Proven reserves :

-> 1733,9 billions barrels [6]

53750,9 billion gallonsAverage on varied oil uses gives ≃ 10 kg CO2 emitted per gallon [20]

-> 537,5 Gt CO2

World CO2 eq budget, current estimations : [21]

1170 Gt CO2 eq to stay <2°C of global warming

420 Gt CO2 eq to stay <1,5°C of global warming

Consomption of all current proven oil reserves is half of our total 2°C world budget and more than our total 1,5°C budget!

Without even considering natural gas, coal, or other emissions (CH4, for example) contributing to radiative forcing...

This considered, without changes, the 2°C threshold should be crossed in about 26 years

[3] BIHOUIX, P., GUILLEBON, B. ,2010. Quel futur pour les métaux?

[10] Data & Statistics,. IEA[online]. Available from : https://www.iea.org/data-and-statistics

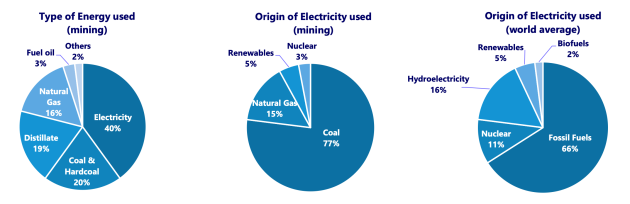

And mining is very dependent of highly carbonated, non renewable energy vectors

Adapted from [3] .The values for World averages of Electricity origin were replaced by updated data rom [10]

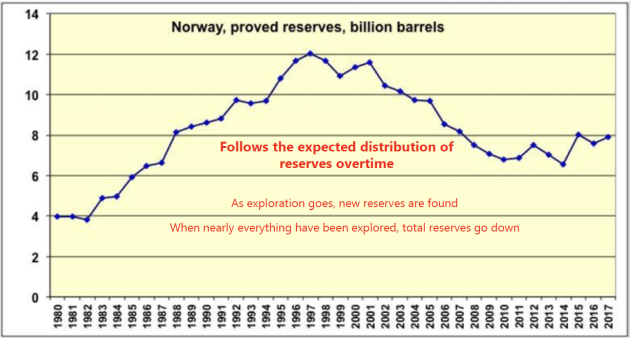

Production peak

[6] BP, 2020. BP Statistical Review of World Energy. [online].

[15] JANCOVICI, J-M, 2019. Les Energies fossiles. Ecole des Mines [online].

[22] World Energy Outlook 2018. IEA –International Energy Agency.

Hypothesis: we don’t mind CO2 eq emissions

Either we consider it’s not a problem

Or we think innovation or start-ups will solve that

-> Exhaustion of Reserves through Production will still occur!

R/P ratio: most simplified model

Considering current reserves [6]

And 2019 rate of consomption [6] taken as constant for the years to come (quite unrealistic hypothesis of no flow reduction)

-> No oil remaining in ≃ 50 years

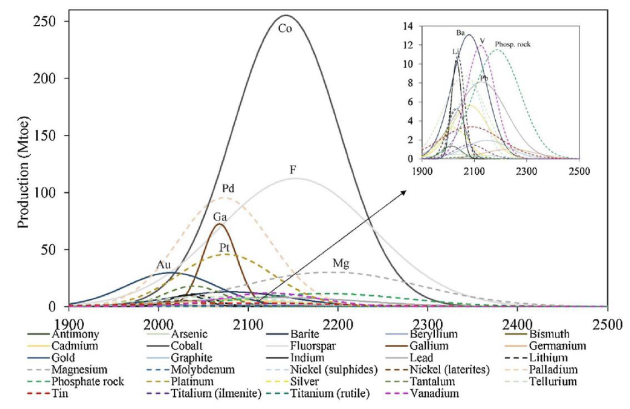

[23] CALVO, G. et al.., 2017. Assessing maximum production peak and resource availability of non-fuel mineral resources.

[15] JANCOVICI, J-M, 2019. Les Energies fossiles. Ecole des Mines [online].

[22] World Energy Outlook 2018. IEA – International Energy Agency.

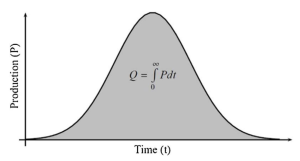

A slightly better estimate: the Hubbert peak model (1956)

We know there is no production at t = 0 and t = t final

The area below the production curve must be equal to the reserve

Regarding conventionnal oil, several countries seems to have peaked already. A review can be found here [15]

It is commonly believed that world production peak of conventionnal oil already happened, in 2008 [22]

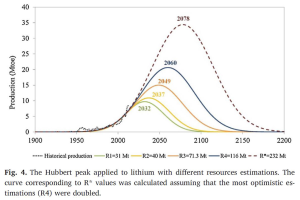

Extracted from [23]

Reliability is influenced by several parameters

Uncertainty regarding reserves information

Particular environmental issues: health, water use, ore grade

Sociopolitical issues: new objects, changes of regulation, or armed conflicts

Interdependencies of byproducts

Substitution & recycling

That said, influence of reserves’ variation is limited when rapported to the current trends in production and growth of production

-> Li case study: estimated reserves x 8 only delayed the peak by 46 years

Extracted from [23]

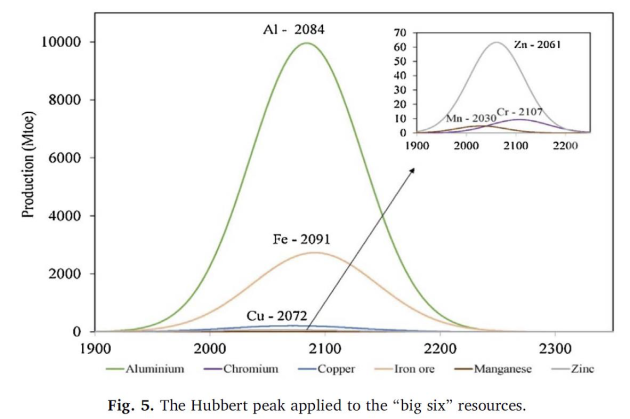

This recent try of systematic assessment is quite interesting to read[23] and accessible!

The time scaling is quite short, even for base metals

Extracted from [23]

Expected peak in the next 50 years : 12 metals over 47 studied: As, Bi, In, Li, Mn, Mo, Ni, Ag, Ta, Te, Zn

30 metals over 47 have their expected peak in the next 100 years

Gold & Antimony peaked arround 2015 (agreement for Gold with [3])

Extracted from [23]

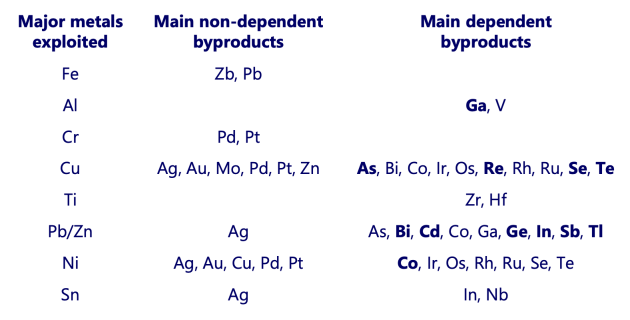

Taking into account the interdependencies of metals

Bold indicates it is the main production process of said metal

Extracted from [3]

[3] BIHOUIX, P., GUILLEBON, B. 2010. Quel futur pour les métaux?

Nearly a half of metals today exploited are interlinked

Extracted from [3]

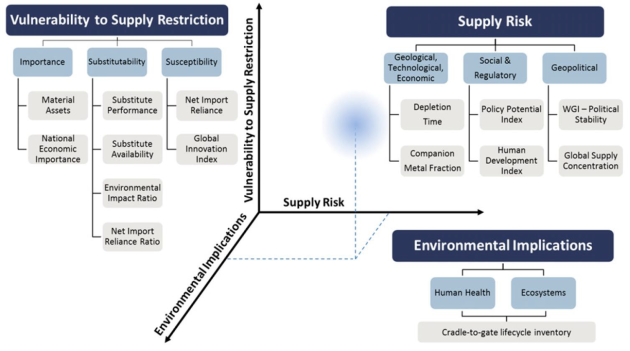

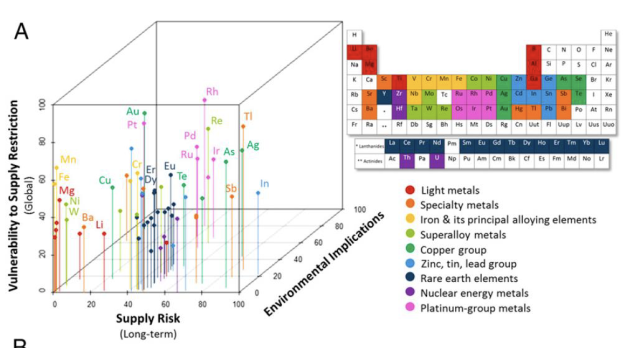

Criticality

[26] GRAEDEL, T. et al., 2015. Criticality of metals and metalloids. DOI 10.1073/pnas.1500415112.

Notion related to the attempt to assess the relative risks concerning the availability of resources

Relatively recent preoccupation

As availability is an already complex notion, its risk analysis is also complex

Geological abondance & concentrations

Potential for substitution

State of the art of mining technology

Amount of regulatory oversight

Geopolitical initiatives

Governmental instability

Economic policy

As reserves are part of the assessment, it is also dynamic

Several methodologies

At different scales of organizations

For different scales of time

With then varied results difficult to compare between each other

Extracted from [26]

Criticality space: a first step is to get an overall idea

A number of metals are concentrated on the middle: moderately high on at least 2 axis (rare earths, Cr, Te, etc.)

Some are regrouped toward lower left: relatively low criticality (Fe, Mg, Ni, Mn, etc.)

The right side: high supply risk (In, Ag, Tl, As, Sb)

The particular case of Au & Pt

Extracted from [23]

This methodology allow the comparison of varid elements for (here at global level) :

Supply risk

Environmental implications

Vulnerability to supply restriction

Keep in mind it is a relative assessment

Per kg comparison

Results may be underestimated

Database of 2008 (they were in the process ofupdating up to 2012 at publication in 2015)

As data revisions are not frequent & major technology changes occurs slowly, they recommand reassessment on a 5 years basis

Extracted from [23]

[25] HUISMAN, J., PAVEL, C., et al. 2020. Critical Raw Materials in Technologies and Sectors - Foresight [online].

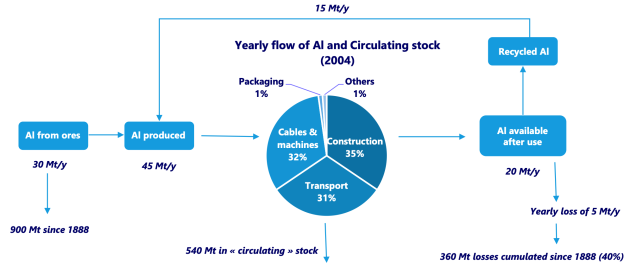

Preserving stocks

Necessity & Limits of Recycling

[3] BIHOUIX, P., GUILLEBON, B. 2010. Quel futur pour les métaux?

Major difference between oil (energy resources) and metals (mineral ressources) :

Oil, Coal & Natural Gas -> mostly burned -> The flow is not retrievable

Metals -> mostly materially conserved -> The flow is retrievable + there is a stock in circulation!

Each year, stocks of metals :

Increases of the producted quantity

Decreases of the lost quantity

Dispersive uses (metals used as dyes or fertilizers)

No recycling (incineration or landfill disposal)

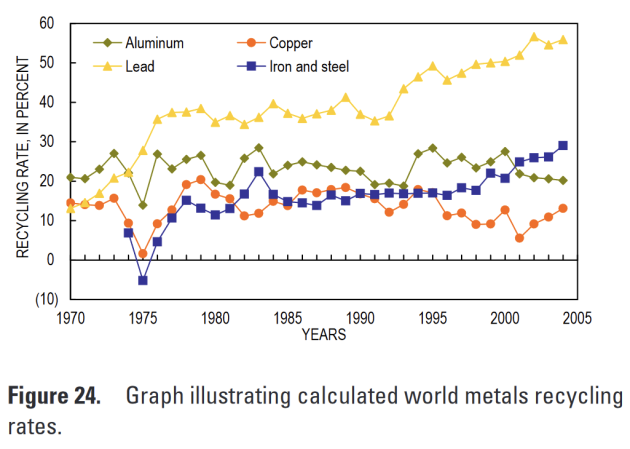

Current recycling

Precious metals (Au) or with moderately high value (Cu): few losses

Less noble metals (Al, Zn) have more important loss rates

No data for a lot of metals used in specific applications (electronics...)

Metals are one of the most interesting category of materials for recycling

Theoretically recyclable an infinite amount of time without diminishing their properties

Have high yield for stock preservation

40% recycling rate -> 80% recycling rate <-> Reserves x 3

50% recycling rate -> 99,9% recycling rate <-> Reserves x 500

Rich countries show that recycling rate can reach high levels for base metals

France (2010): 85% for Fe ; 80% for Al & Cu ; 70% Pb ; 50% Zn [3]

But it cannot do everything

No industrial process have a 100% efficiency -> same for recycling (remelt Al generate a dispersed loss of 1-2%)

A lot of our uses are not compatible with recycling

The trend of higher complexity

> 30 metals in a computer

> 10 alloys of Steel in a car

Prevent us from retrieving the resources: not easy and sometimes techically impossible to detect or separate metals of an allow

This phenomena exist for a lot of our metarials

Glass: mix of transparent & colored glasses -> no more use in most of construction or cars, only bottles

Plastic: often reused in less demanding uses (technically or aestetically)

-> Important to rethink life-cycles of products, raw materials, and mostly uses

-> Integrate less performant or pretty materials & more recycled materials

-> Organize recovery channels to boost recycling rate

-> But also question the trend of high tech solutions instead of low tech ones

-> That is, question the needs

The trend of direct dispersive uses

Dyes (98% of Ti used as TiO2 for white dyes)

Fertilizers (P, Zn, etc.)

Additives (Cr in Glass)

Pesticides (CuSO4 in some organic farming plants)

And « indirecty » dispersive uses (very difficult to recover)

33% of Sn is used in welding

50% of Zn is used in galvanizing

Some metals like Co or Mb are nearly exclusively used in dispersive uses or alloys

The socioeconomic limits

Economical incentives to constructors are not present or sufficient

Lack of reglementation and means to enforce it

Complexity of products and recovery channels does not help

Substitution

Limit the use in rare or noble metals in favor of abondant metals

Critical lens on « innovation »

Aim to maximize a low tech approach as much as possible at the level of product and technology

-> For inorganic solar pannels, Si should be prefered to GaAs, CIGS, and others, even if the conversion efficiency is less important

For critical cases, possibilities needs to be carefully explored :

Cr nearly indispensible for anti-corrosion

-> Ti can replace Cr in certain cases but its energy footprint is 4-5 times higher

Cu nearly indispensible for electrical applications

-> Al can replace Cu in certain cases but its energy footprint is 2-3 times higher

Substituate oil by electrification? [27]

Li-ion batteries represented 37% of Li consumption in 2016 (and 40% of Co)

Batteries for electric vehicules were only 10% of Li-ion consumption in 2018

Most elements at disposal indicates that strong choices of resources’s uses will have to be made in the years to come :

[27] Responsible minerals sourcing for renewable energy, 2019. University of Technology Sydney [online].

[28] ABDALLA, A. et al., 2018. Hydrogen production, storage, transportation and key challenges with applications: A review. DOI 10.1016/j.enconman.2018.03.088

[29] SCHMIDT, O., et al., 2017. Future cost and performance of water electrolysis: An expert elicitation study. DOI 10.1016/j.ijhydene.2017.10.045.

Substituate oil by « hydrogen »?

Currently > 90% of H2 is produced by steam reforming (10 kg CO2 per kg of H2 produced) [28]

Water electrolysis / fuel cells have problems of their own [29]

Alkaline electrolysis is not adapted for electric cars

New technologies currently depends either on Pt and are not industrially mature (PEM) or rare earths and are at the state of demonstrators (SO)

In need of a big & new infrastructure for supply of cars

-> We are back to the vicious circle of energy & material footprint

Challenging needs

[30] BIHOUIX, Philippe, 2014. L’Age des low techs : vers une civilisation techniquement soutenable. Seuil.

The often most efficient stategy to preserve abiotic resources stock

House thermally isolated + put on a sweater >>> room heating technical solution

Most transport on bicycle (short distance) + train (long distance) with minimal use of a car (occasional rental) >>> electric cars replacing current diesel and petrol cars

Simple dismountable and repairable electronics >>> computer assembly with glue with digital prints technology

It is the first of the 7 principles of low-techs [30]

Challenging needs

Design and produce truly sustainable

Orienting knowledge to resources’ savings

Striking a technical balance between performance & conviviality

Relocalize without losing the right scale effects

De-machinizing services

Knowing to remain modest

Indeed this kind of transition imply numerous socioeconomical consequences

As any kind of transition, it is also a matter of flows and their evolution

Medias

A matter of Flow

The flows’s stakes

Climate change

[31] IPCC. 2014: mitigation of climate change: Working Group III contribution to the 5th Assessment Report of the IPCC.

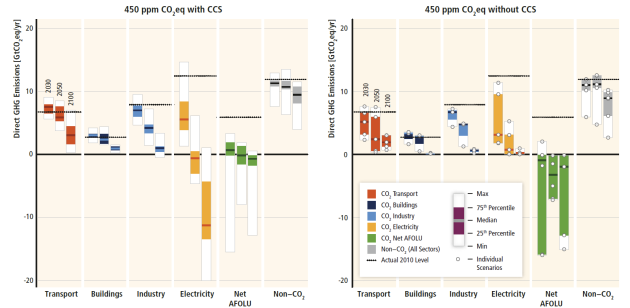

Trajectories mitigating climate change all require a global limitation of material & energy flows

Even with the hypothesis of a high developpment of the use of carbon capture and storage (CCS) technologies

[32] HCC, 2020. Maîtriser l’empreinte carbone de la France. Haut Conseil pour le Climat [online].

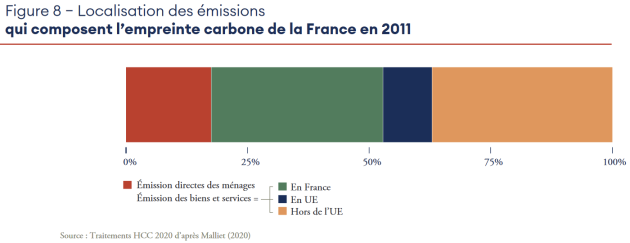

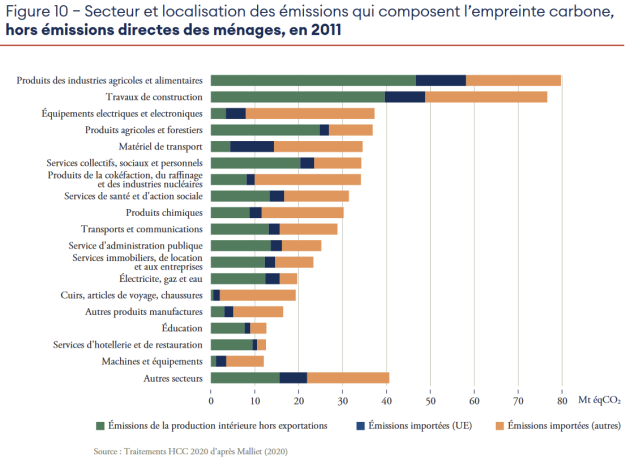

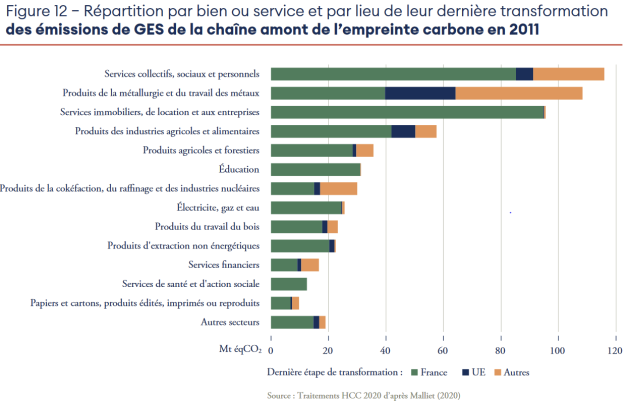

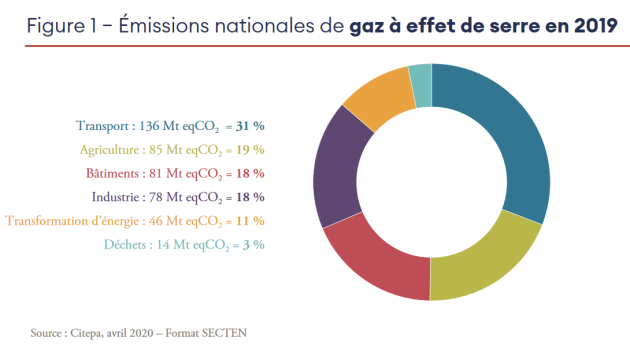

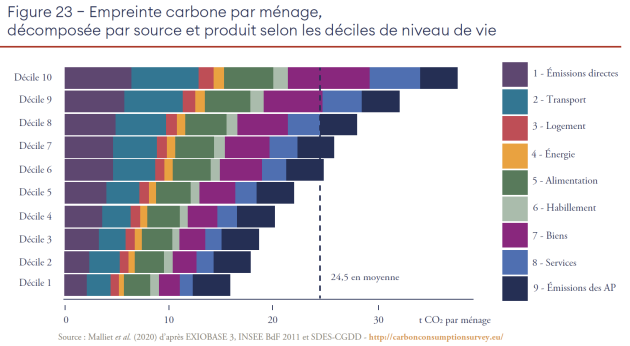

The French carbon footprint

A large part of our carbon footprint comes from importations

The French situation

Mineral resources: metals & cement

Energy resources & chemical products: oil

Abiotic resources are a large part of it, metals in particular!

In terms of weight of abiotic resources in domestic emissions: oil is dominant through transport (direct emissions), followed by metals & cement (indirect and distributed emissions)

High mitigation potential in transport <-> Combination of varied measures [31]

Low-carbon fuels -> higher flows of metals & lower flow of oil

Lowering vehicules energy intensities -> lower flows of oil & metals

Encouraging modal shift to lower-carbon passenger & freight systems

-> lower flows of oil + short-to-medium term higher flows of metals for infrastructure investments

Avoid journeys where possible -> lower flows of oils

This kind of configuration apply generally

Specific augmentations in flows of metal are required to lower oil flows

Competition between uses requiring metals -> priorities will need to be established

Economics interdependancies

[15] JANCOVICI, Jean-Marc, 2019. Les Energies fossiles. Ecole des Mines [online].

[34] HABERL, H., et al, 2020. A systematic review of the evidence on decoupling of GDP, resource use and GHG emissions, part II : synthesizing the insights. DOI 10.1088/1748-9326/ab842a.

[33] HCC, 2020. Rapport annuel - Redresser le cap, relancer la transition. Haut Conseil pour le Climat [online]. 2020.

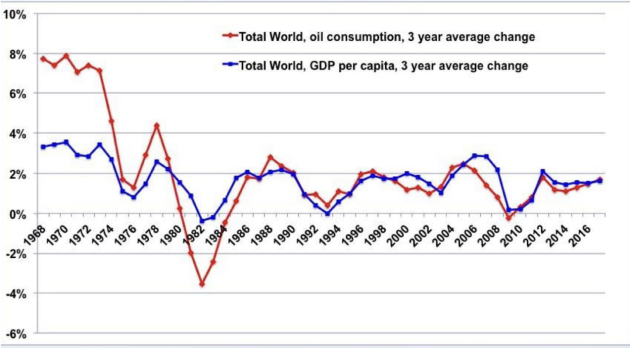

At world scale, there is a historical link between primary energy & material consumption, and economic production (as measured by GDP) [15] & [34]

There is no consensus on the exact nature of the relationship nowadays [33]

But we know that energy & material availability enables GDP growth

And GDP growth, by anticipation of economic growth causes energy & material use

A lot of ambitious climate target rely on the concept of « decoupling » [34]

Promotion of economic growth while reducing material & energy footprint (EMF)

When theorized as absolute -> EMF reduction & GDP growth

When theorized as relative -> EMF slow growth & GDP high growth

Recent systematic review clarifies that :

Relative decoupling is frequent for material use, GHG emissions, but not exergy

Relative decoupling of GDP and primary energy use can be caused by energy efficiency (higher ratio of exergy / primary energy use)

Absolute decoupling situations are very rare and are related to small short-term reductions of emissions

No evidence that absolute decoupling can be generalized

Degrowth/Sufficiency currently seems indispensible to meet climate target and sustainable use of abiotic resources:

Require a contraction of current economics functionning

And even fundamental changes in its functionning too

A byproduct of this scientific inquiries is that GDP is more & more considered as an irrelevant indicator for these problematics

Volatility of prices

[35] ECORYS, 2012. Mapping resource prices: the past & the future [online]. Final report to European Comission.

Base metals’ prices are historically quite constant relatively to each others but individual resource’s price is highly volatile [35]

[6] BP, 2020. BP Statistical Review of World Energy. [online].

Oil’s price is highly volatile too[6]

Resources’s prices underlying determinations

Percieved availability through control of producers

Degree of substitutability

Resources’s prices mecanisms of formations

Over-the-counter (OTC) markets: traditionnal mecanism

Annual or multi-year supply contracts: mainly, Fe and Fe allows

Pricing on forward markets

Special case of precious metals: considered as quasi-money or OTC.

Historically, numerous resources exchanges were operated by intermediates

Contemporary period: developpment of financialization

Alignment of Raw materials on securities -> far less intermediaries

Developpment of financial product derivatives + capitalistic concentrations of producers

-> overvalued prices and speculations

[36] MITTEAU, Gilles, 2018. Economie et finance du pétrole - Heu?reka. [online].

Financial markets’s specific effects

Efficiency of market -> Trends of prices themselves tend to diseapear

Short-term interest of traders -> Short-term volatility

Complexity of the product and implications of prices variations on the economy

-> Long-term volatility + impossibility to know for sure the causes of prices variations

-> There is no « natural price-signalling » mecanism that makes a non- renewable resource progressively more expensive overtime

-> The « natural » functionning of Financial markets seems to impply that the reduction of energy & material flows lead to higher volatility, or maybe higher « volatility of volatility »

For detailed reasonning, strong recommendation of Youtuber Heu?reka on Economy & Finance of oil

Contracting flows

Limits of efficiency

Like recycling, energy efficiency is necessary

Allow to reduce flows for a given performance

25% energy yield -> 30% energy yield -> 1/6 of oil flows spared per year

25% energy yield -> 50% energy yield -> 1/2 of oil flows spared per year

Same goes for « material efficiency » (diminshing the quantity of material needed to achieve a given functionnality)

But it is not sufficient, and could even be harmful on the global scale

Energy efficiency, when only measure applied, have mainly cost reduction effects

Cost reduction could then lead to democratize preexisting uses or create new ones

This then would lead to an overall increase in energy consumption

[37] SORRELL, Steve, 2007. The Rebound Effect: an assessment of the evidence for economy-wide energy savings from improved energy efficiency. [online]. UKERC

This would be called a « rebound effect » [37]

The « economy-wide » rebound effect is of combination of direct and indirect rebound effects that can interact with each other

Some basic examples of direct rebound effect :

If fuel-efficient vehicules make travel cheaper -> Consumers may choose to drive further / more often -> Offsets the energy savings

If a factory uses energy more efficiently -> Becomes more profitable -> May generate further investments -> More production

Some basic examples of indirect rebound effect :

Drivers of fuel-efficient cars may spend the money saved bying petrol on other energy intensive goods or services (ex: overseas flight)

[38] JEVONS, William Stanley, 1865. The Coal Question. . 1865. P. 213.

Rebound effect concept coms back to the XIXth century

Firstly known as « Jevons paradox » from W. J. Jevons [38]

Steam-engines’ efficiency had been increased by 10-fold at least in a century

Consumption of coal had greatly increased anyway (x 6 in 50 years)

The same considerations could be made about today :

Energy efficiency of cars’ engines have never been better

Our oil cosumption dedicated to it have never been higher

-> Could be explained by:

The growth of car use driven by low cost of oil

And spared cost of cars invested in high-tech supplementary functions which increase car’s weight and maintain oil consumption

The increase in heavy vehicules like SUVs

[39] STERN, David I., 2017. How accurate are energy intensity projections?. DOI 10.1007/s10584-017-2003-3.

Quantified contemporary estimations are complicated :

There is indeed a correlation between various measures of energy efficiency and continuing growth of overall energy consumption

But the causal links between these trends are not clear

Difficulty to assess other things than direct rebound effects

That being said, evidence suggest that : [37]

It has the potential to widely vary between technologies, sectors, income groups

In OECD countries, automotive transport, household heating & cooling can relatively robustly be considered subjects to a direct rebound effect of 10-30% (microscale)

Current energy or material efficiency policies are not up to the task (macroscale)

Predictions of energy footprint decline itself are generally too optimistic [39]

Physics inevitability

[40] HALL, Charles A. S., et al., 2014. EROI of different fuels and the implications for society. DOI 10.1016/j.enpol.2013.05.049.

Material & Energy flows will decline anyway due to the physics underlying the production peak

We’ve seen that the decline in ores’s grade do lead to an exponential demand in energy for base metals extraction, and that a mineralogical barrier can happen for rarer metals

But oil itself needs energy to be extracted!

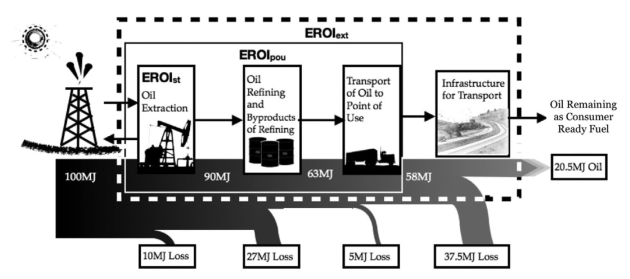

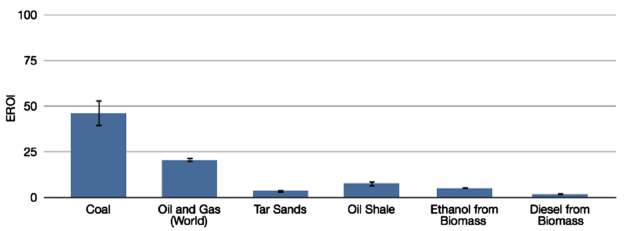

Last notion of this course : EROI – Energy return on investment

Ratio of energy delivered by a specific energy vector and the energy invested in the capture & delivery of this energy

Measures the relative quality of energy vectors

Varied possible choices of boundaries in systemic assessments, so as much EROI calculations: standard ; point of use ; extended ; societal

Estimates re complicated due to oil compagnies low level of transparency

As oil is often extracted together with natural gas, calculations can be tricky

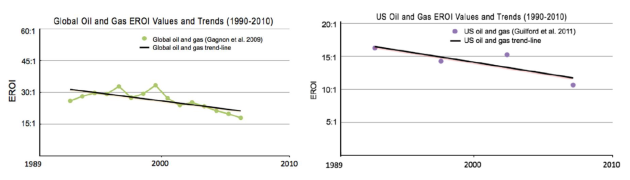

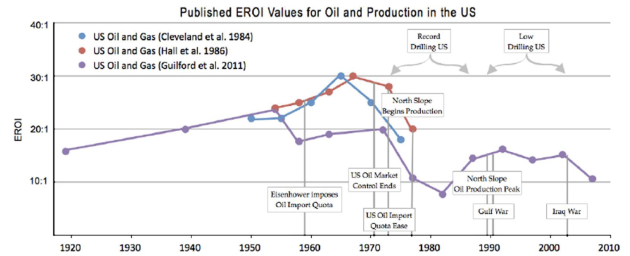

But all estimates tend to show a progressive decrease in EROI for every place where data is available : here in USA

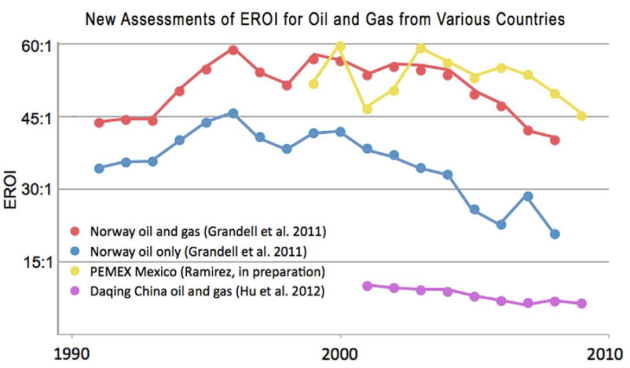

Is there a trend for oil already?

It seems so

All estimates tend to show a progressive decrease in EROI for every place where data is available : here in USA

Is there a trend for oil already?

Pretty much so!

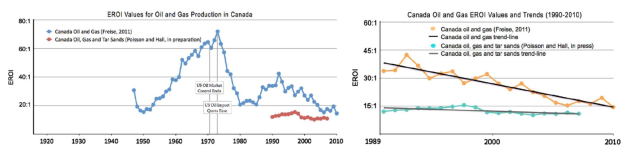

All estimates tend to show a progressive decrease in EROI for every place where data is available : here in Canada

Is there a trend for oil already?

Undeniably so!

All estimates tend to show a progressive decrease in EROI for every place where data is available : here in various other countries

It is logical from what we’ve seen about the concentration of resources in general. But why does it especially matter here?

The decrease of the EROI of conventionnal oil means we’ll need to set aside a growing share of the oil flows just to continue to have a flow

This share of oil « lost » will no longer be used to supply other sectors [36]

Non conventionnal oils have a base EROI quite lower than conventionnal (and will also decrease with their further exploitation) [40]

Managing consequences, tackling causes

[36] MITTEAU, Gilles, 2018. Economie et finance du pétrole -Heu?reka. [online].

[40] HALL, Charles A. S., et al., 2014. EROI of different fuels and the implications for society. DOI 10.1016/j.enpol.2013.05.049.

[33] HCC, 2020. Rapport annuel -Redresser le cap, relancer la transition. Haut Conseil pour le Climat [online]. 2020.

As there is no absolute decoupling, a contraction & instability of economy and as we know it seems unavoidable in the medium-term, regardless of climate change [36] & [40]

By « economy », here, we mean that all socioeconomical & geopolitical relationships will be impacted

Social acceptability of dynamics created by contracting flows will be a key component of the success ofmitigating policies [33]

-> Ecological transition is also a social one

This is were we, as engineers & citizens, have apart to play

We would gain a lot to take inspiration from the 7 principles of low-techs [30]

Challenging needs

Design and produce truly sustainable

Orienting knowledge to resources’ savings

Striking a technical balance between performance & conviviality

Relocalize without losing the right scale effects

De-machinizing services

Knowing to remain modest

[30] BIHOUIX, Philippe, 2014. L’Age des low techs : vers une civilisation techniquement soutenable. Seuil.

Medias

Bibliography

[1] BEYLOT, Antoine, ARDENTE, Fulvio, SALA, Serenella and ZAMPORI, Luca, 2020. Accounting for the dissipation of abiotic resources in LCA: Status, key challenges and potential way forward. Resources, Conservation and Recycling. 1 June 2020. Vol. 157, p. 104748. DOI 10.1016/j.resconrec.2020.104748.

[2] Resource, 2020. Wikipedia [online]. Available from: https://en.wikipedia.org/w/index.php?title=Resource&oldid=982763984

[3] BIHOUIX, Philippe, GUILLEBON, Benoît de and CENTRE NATIONAL DU LIVRE (FRANCE), 2010. Quel futur pour les métaux? raréfaction des métaux: un nouveau défi pour la société. Les Ulis, France: EDP sciences. ISBN 978-2-7598-0713-0.

[4] History of the oil shale industry, 2020. Wikipedia [online]. Available from: https://en.wikipedia.org/w/index.php?title=History_of_the_oil_shale_industry&oldid=966512236

[5] ALIX, Pierre, BURNHAM, Alan, FOWLER, Tom, KLEINBERG, Michael and SYMINGTON, Bill, 2010. Coaxing Oil from Shale. Oilfield Review [online]. 2011 2010. Vol. 22, no. 4. Available from: https://web.archive.org/web/20150106093639/http://www.slb.com/~/media/Files/resources/oilfield_review/ors10/win10/coaxing.ashx

[6] BP, 2020. BP Statistical Review of World Energy. [online]. 2020. No. 69. Available from: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2020-full-report.pdf

[8] Petroleum, 2020. Wikipedia [online]. Available from: https://en.wikipedia.org/w/index.php?title=Petroleum&oldid=985135121

[9] BONNEUIL, Christophe and FRESSOZ, Jean-Baptiste, 2016. L’événement anthropocène: la Terre, l’histoire et nous. Nouvelle éd. révisée et augmentée. Paris: Éditions Points. ISBN 978-2-7578-5959-9.

[10] Data & Statistics. IEA [online]. Available from: https://www.iea.org/data-and-statistics

[11] USGS, 2014. Estimate of Undiscovered Copper Resources of the World [online]. Fact Sheet. Fact Sheet. Available from: https://pubs.usgs.gov/fs/2014/3004/pdf/fs2014-3004.pdf

[12] USGS, 2020. Mineral Commodity Summaries [online]. Available from: https://pubs.usgs.gov/periodicals/mcs2020/mcs2020.pdf

[13] SKINNER, B.J., 1979. Chapter 10 A Second Iron Age Ahead? In: Studies in Environmental Science [online]. Elsevier. p. 559–575. ISBN 978-0-444-41745-9. Available from: https://linkinghub.elsevier.com/retrieve/pii/S0166111608710719

[14] AYRES, Robert U, 2001. Resources, Scarcity, Growth and the Environment. . 2001. P. 35.

[15] JANCOVICI, Jean-Marc, 2019. Les Energies fossiles. Ecole des Mines [online]. 2019. Available from: https://drive.google.com/drive/folders/1fqoACrCFtlXKonP266DkFUcmMVj22yj_

[16] ELAW, Environmental Law Alliance Worldwilde, 2010. 1st Edition: Guide pour l’évaluation de EIE de projets miniers [online]. Available from: https://www.elaw.org/files/mining-eia-guidebook/Chapitre%201.pdf

[17] Hydraulic Fracturing 101, [no date]. Earthworks [online]. Available from: https://www.earthworks.org/issues/hydraulic_fracturing_101/

[18] RITCHIE, Hannah and ROSER, Max, 2017. CO₂ and Greenhouse Gas Emissions. Our World in Data [online]. 11 May 2017. Available from: https://ourworldindata.org/co2-and-other-greenhouse-gas-emissions

[19] BONNEUIL, Christophe and FRESSOZ, Jean-Baptiste, 2016. L’événement anthropocène: la Terre, l’histoire et nous. Nouvelle éd. révisée et augmentée. Paris: Éditions Points. ISBN 978-2-7578-5959-9. [Same that [9], little mistake on my part here)

[20] EIA, U.S. Energy Information Administration, 2016. Carbon Dioxide Emissions Coefficients. [online]. 2016. Available from: https://www.eia.gov/environment/emissions/co2_vol_mass.php

[21] ROGELJ, Joeri, SHINDELL, Drew, JIANG, Kejun, FIFITA, Solomone, FORSTER, Piers, GINZBURG, Veronika, HANDA, Collins, KOBAYASHI, Shigeki, KRIEGLER, Elmar, MUNDACA, Luis, SÉFÉRIAN, Roland, VILARIÑO, Maria Virginia, CALVIN, Katherine, EMMERLING, Johannes, FUSS, Sabine, GILLETT, Nathan, HE, Chenmin, HERTWICH, Edgar, HÖGLUND-ISAKSSON, Lena, HUPPMANN, Daniel, LUDERER, Gunnar, MCCOLLUM, David L, MEINSHAUSEN, Malte, MILLAR, Richard, POPP, Alexander, PUROHIT, Pallav, RIAHI, Keywan, RIBES, Aurélien, SAUNDERS, Harry, SCHÄDEL, Christina, SMITH, Pete, TRUTNEVYTE, Evelina, XIU, Yang, ZHOU, Wenji, ZICKFELD, Kirsten, FLATO, Greg, FUGLESTVEDT, Jan, MRABET, Rachid and SCHAEFFER, Roberto, 2018. Mitigation Pathways Compatible with 1.5°C in the Context of Sustainable Development. In: Global Warming of 1.5°C. An IPCC Special Report on the impacts of global warming of 1.5°C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty [Masson-Delmotte, V., P. Zhai, H.-O. Pörtner, D. Roberts, J. Skea, P.R. Shukla, A. Pirani, W. Moufouma-Okia, C. Péan, R. Pidcock, S. Connors, J.B.R. Matthews, Y. Chen, X. Zhou, M.I. Gomis, E. Lonnoy, T. Maycock, M. Tignor, and T. Waterfield (eds.)]. In Press.

[22] World Energy Outlook 2018 - Analysis and key findings. A report by the International Energy Agency.

[23] CALVO, Guiomar, VALERO, Alicia and VALERO, Antonio, 2017. Assessing maximum production peak and resource availability of non-fuel mineral resources: Analyzing the influence of extractable global resources. Resources, Conservation and Recycling. 1 October 2017. Vol. 125, p. 208–217. DOI 10.1016/j.resconrec.2017.06.009.

[24] PRIOR, T., GIURCO, D., MUDD, G., MASON, L. and BEHRISCH, J., 2012. Resource depletion, peak minerals and the implications for sustainable resource management. Global Environmental Change. 1 August 2012. Vol. 22, no. 3, p. 577–587. DOI 10.1016/j.gloenvcha.2011.08.009.

[25] HUISMAN, J. and PAVEL, C., 2020. Critical Raw Materials in Technologies and Sectors - Foresight [online]. European Commission - Joint Research Centre. Available from: https://ec.europa.eu/docsroom/documents/42881

[26] GRAEDEL, T. E., HARPER, E. M., NASSAR, N. T., NUSS, Philip and RECK, Barbara K., 2015a. Criticality of metals and metalloids. Proceedings of the National Academy of Sciences. 7 April 2015. Vol. 112, no. 14, p. 4257–4262. DOI 10.1073/pnas.1500415112.

[27] Responsible minerals sourcing for renewable energy, 2019. University of Technology Sydney [online]. Available from: https://www.uts.edu.au/research-and-teaching/our-research/institute-sustainable-futures/our-research/resource-futures/responsible-minerals-for-renewable-energy

[28] ABDALLA, Abdalla M., HOSSAIN, Shahzad, NISFINDY, Ozzan B., AZAD, Atia T., DAWOOD, Mohamed and AZAD, Abul K., 2018. Hydrogen production, storage, transportation and key challenges with applications: A review. Energy Conversion and Management. 1 June 2018. Vol. 165, p. 602–627. DOI 10.1016/j.enconman.2018.03.088.

[29] SCHMIDT, O., GAMBHIR, A., STAFFELL, I., HAWKES, A., NELSON, J. and FEW, S., 2017. Future cost and performance of water electrolysis: An expert elicitation study. International Journal of Hydrogen Energy. 28 December 2017. Vol. 42, no. 52, p. 30470–30492. DOI 10.1016/j.ijhydene.2017.10.045.

[30] BIHOUIX, Philippe, 2014. L’Age des low techs : vers une civilisation techniquement soutenable. Seuil.

[31] INTERGOVERNMENTAL PANEL ON CLIMATE CHANGE and EDENHOFER, Ottmar (eds.), 2014. Climate change 2014: mitigation of climate change: Working Group III contribution to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. New York, NY: Cambridge University Press. ISBN 978-1-107-05821-7. QC903 .I492 2014

[32] HCC, 2020b. Maîtriser l’empreinte carbone de la France [online]. Available from: https://www.hautconseilclimat.fr/actualites/le-hcc-presente-son-rapport-maitriser-lempreinte-carbone-de-la-france/

[33] HCC, 2020a. Rapport annuel - Redresser le cap, relancer la transition [online]. Available from: https://www.hautconseilclimat.fr/publications/rapport-annuel-2020/

[34] HABERL, Helmut, WIEDENHOFER, Dominik, VIRÁG, Doris, KALT, Gerald, PLANK, Barbara, BROCKWAY, Paul, FISHMAN, Tomer, HAUSKNOST, Daniel, KRAUSMANN, Fridolin, LEON-GRUCHALSKI, Bartholomäus, MAYER, Andreas, PICHLER, Melanie, SCHAFFARTZIK, Anke, SOUSA, Tânia, STREECK, Jan and CREUTZIG, Felix, 2020. A systematic review of the evidence on decoupling of GDP, resource use and GHG emissions, part II: synthesizing the insights. Environmental Research Letters. June 2020. Vol. 15, no. 6, p. 065003. DOI 10.1088/1748-9326/ab842a.

[35] ECORYS, 2012. Mapping resource prices: the past & the future [online]. Final report to European Comission. Available from: https://ec.europa.eu/environment/enveco/resource_efficiency/pdf/studies/report_mapping_resource_prices.pdf

[36] MITTEAU, Gilles, 2018a. Economie et finance du pétrole - Heu?reka. [online]. 2018. Available from: https://www.youtube.com/playlist?list=PLbHgDl1izvbnWaSCpgo6m4Z1EGBT6QBJ5

[37] SORRELL, Steve, 2007. The Rebound Effect: an assessment of the evidence for economy-wide energy savings from improved energy efficiency. [online]. UKERC. Available from: https://businessdocbox.com/Green_Solutions/70206684-The-rebound-effect-an-assessment-of-the-evidence-for-economy-wide-energy-savings-from-improved-energy-efficiency-october-2007.html

[38] JEVONS, William Stanley, 1865. The Coal Question. 1865. P. 213.

[39] STERN, David I., 2017. How accurate are energy intensity projections? Climatic Change. 1 August 2017. Vol. 143, no. 3, p. 537–545. DOI 10.1007/s10584-017-2003-3.

[40] HALL, Charles A. S., LAMBERT, Jessica G. and BALOGH, Stephen B., 2014. EROI of different fuels and the implications for society. Energy Policy. 1 January 2014. Vol. 64, p. 141–152. DOI 10.1016/j.enpol.2013.05.049.

Supplmentary bibliographical references that might interest you:

CALAS, Georges, 2014. Les ressources minérales, un enjeu majeur dans le contexte du développement durable. [online]. 2015 2014. Available from: https://www.college-de-france.fr/site/georges-calas/course-2014-2015.htm

Energy Policies of IEA Countries: United States 2019 Review. IEA Webstore [online]. Available from: https://webstore.iea.org/energy-policies-of-iea-countries-united-states-2019-review

HABIB, Komal, HAMELIN, Lorie and WENZEL, Henrik, 2016. A dynamic perspective of the geopolitical supply risk of metals. Journal of Cleaner Production. 1 October 2016. Vol. 133, p. 850–858. DOI 10.1016/j.jclepro.2016.05.118.

HABIB, Komal, SCHMIDT, Jannick H. and CHRISTENSEN, Per, 2013. A historical perspective of Global Warming Potential from Municipal Solid Waste Management. Waste Management. 1 September 2013. Vol. 33, no. 9, p. 1926–1933. DOI 10.1016/j.wasman.2013.04.016.

HABIB, Komal and WENZEL, Henrik, 2014. Exploring rare earths supply constraints for the emerging clean energy technologies and the role of recycling. Journal of Cleaner Production. 1 December 2014. Vol. 84, p. 348–359. DOI 10.1016/j.jclepro.2014.04.035.

IEA, 2021. The Role of Critical Minerals in Clean Energy Transitions [online]. IEA. Available from: https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions

MEYER, R. La Capture et Séquestration de Carbone pour réduire nos émissions de CO2 - CARBONE#4, 2020. [online]. Available from: https://www.youtube.com/watch?v=AQlqQEhVi1M

PARRIQUE, Timothée, 2019. The political economy of degrowth [online]. phdthesis. Stockholms universitet. Available from: https://tel.archives-ouvertes.fr/tel-02499463

RECK, B. K. and GRAEDEL, T. E., 2012. Challenges in Metal Recycling. Science. 10 August 2012. Vol. 337, no. 6095, p. 690–695. DOI 10.1126/science.1217501.

SCHAFFARTZIK, Anke, MAYER, Andreas, GINGRICH, Simone, EISENMENGER, Nina, LOY, Christian and KRAUSMANN, Fridolin, 2014. The global metabolic transition: Regional patterns and trends of global material flows, 1950–2010. Global Environmental Change. May 2014. Vol. 26, p. 87–97. DOI 10.1016/j.gloenvcha.2014.03.013.

SCHRIJVERS, Dieuwertje, HOOL, Alessandra, BLENGINI, Gian Andrea, CHEN, Wei-Qiang, DEWULF, Jo, EGGERT, Roderick, VAN ELLEN, Layla, GAUSS, Roland, GODDIN, James, HABIB, Komal, HAGELÜKEN, Christian, HIROHATA, Atsufumi, HOFMANN-AMTENBRINK, Margarethe, KOSMOL, Jan, LE GLEUHER, Maïté, GROHOL, Milan, KU, Anthony, LEE, Min-Ha, LIU, Gang, NANSAI, Keisuke, NUSS, Philip, PECK, David, RELLER, Armin, SONNEMANN, Guido, TERCERO, Luis, THORENZ, Andrea and WÄGER, Patrick A., 2020. A review of methods and data to determine raw material criticality. Resources, Conservation and Recycling. 1 April 2020. Vol. 155, p. 104617. DOI 10.1016/j.resconrec.2019.104617.

STERN, David I., 2020. How large is the economy-wide rebound effect? Energy Policy. 1 December 2020. Vol. 147, p. 111870. DOI 10.1016/j.enpol.2020.111870.

UNEP (ed.), 2013. Metal recycling: opportunities, limits, infrastructure: this is report 2b of the Global Metal Flows Working Group of the International Resource Panel of UNEP. Nairobi, Kenya: United Nations Environment Programme. ISBN 978-92-807-3267-2.